You can avoid the high plan fees that rob your retirement dreams if you know how. Our program will show you how to uncover these fees and how best to avoid them.

In a 401K plan, the balance in your account when you retire will determine what kind of retirement you have. While you can maximize your current contributions and company match, fees and expenses paid by the plan can substantially erode the growth in your plan assets.

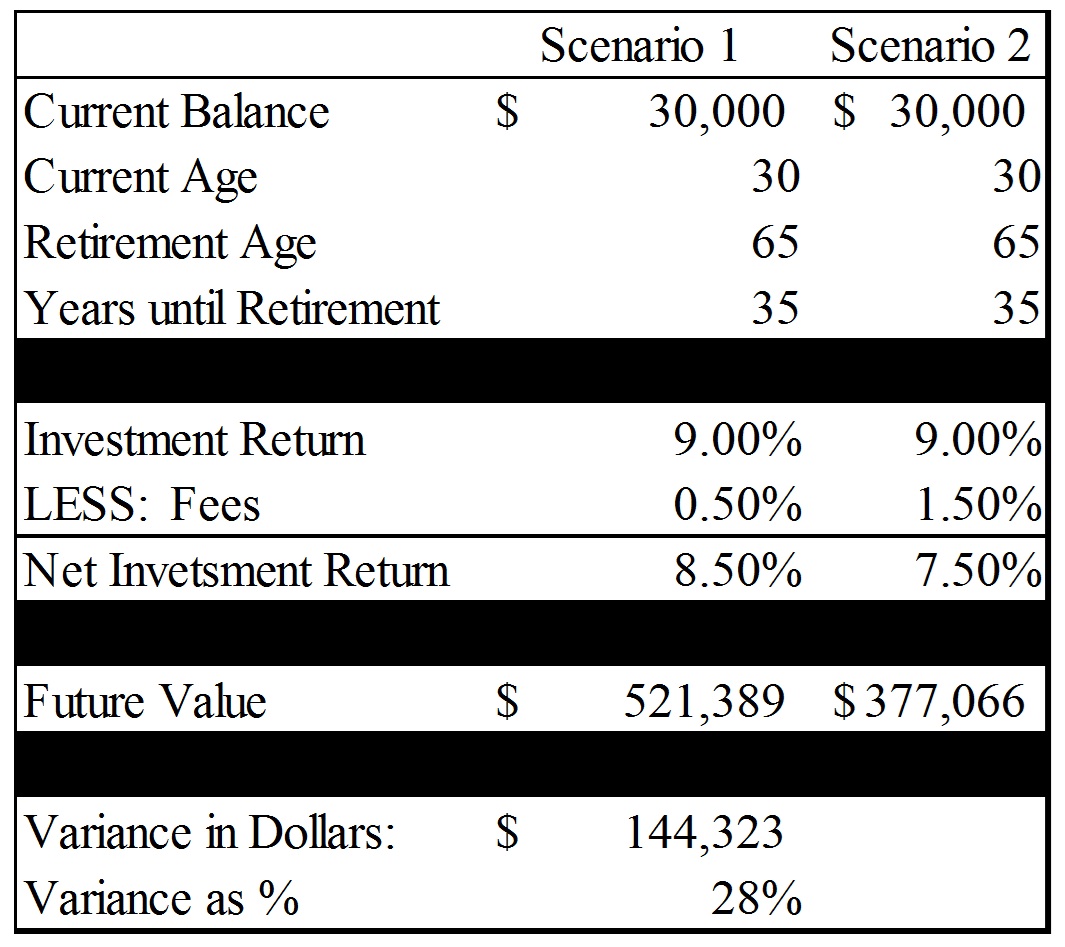

The table below offers an example of a thirty-year-old earning $30,000 a year who plans to retire thirty-five years later, at age sixty-five.

In scenario 1, the thirty-five-year average gross return of her plan assets was nine percent. She selected low-cost index funds and had fees and expenses of only fifty basis points. That left her an average net return of 8.5%. Assuming no further contributions were made her fund balance would grow to a retirement value of over $520,000.

In scenario 2, the same plan assets only grow to $377,000 despite earning the same average gross return. The difference of $144,000 is attributed to higher fees and expenses by 100 basis points. Although it may not sound like much, fees higher by just one percent can reduce your retirement assets by as much as 28% over your working horizon.

This is a substantial reduction in plan assets that would have a material negative effect on your lifestyle in retirement. In fact, it may even cause you to delay retirement because you may not have sufficient assets on which to live.

If you ignore fund fees and expenses, you do so at your own risk.